structuring finance, we provide comprehensive financial ingenuity to mobilise resources for projects to strengthen the asset base of investors.

unearthing existing potential and capacity to produce high value products, increase absorptive capacities, that result in higher development impact across portfolios.

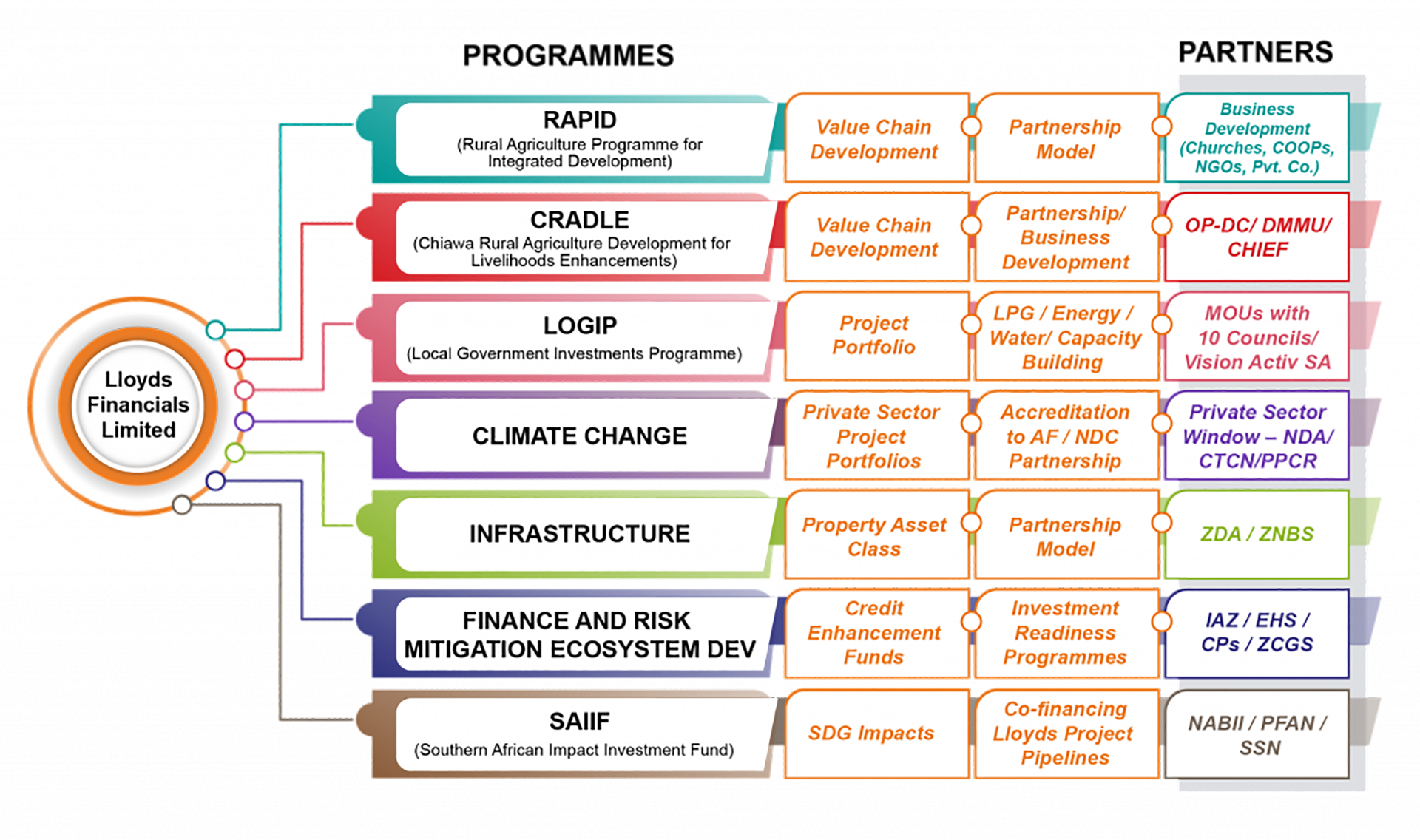

RAPID is a positive rural economic transformation and accelerated integrated development for improved livelihoods. The programme is structured to create vibrant economic hubs that support agricultural production, agribusinesses through value addition and exploitation of value chains. Programme specific objectives:

- Facilitate transformation of rural communities into productive and climate resilient economic growth hubs;

- Catalyse behavioural change towards higher production and adoption of climate smart agriculture (CSA);

- Foster deployment of appropriate agricultural machinery and other input systems to increase production and productivity;

- Facilitate market access for rural outputs/ products;

- Harness development finance for market development strategies; and

- Develop project portfolios for impact investments at scale with potential regional growth

CRADLE is the Chiawa Rural Agricultural Development and Livelihoods Enhancement project. For some time now, the Chiawa community in Southern Province of Zambia, has been experiencing food shortages and declining economy due to the negative impacts of climate change and a constricting national economy. CRADLE is, therefore designed to significantly reduce poverty in Chiawa by stimulating the local economy through a more vibrant agriculture practice and commercialization. This will be done by enhancing farmer individual and organizational skills, productive capacities and building private sector partnerships to develop value chains that will make Chiawa a rural economic hub.

The Local Government Investment Support Programme (LOGIP) is a Private Sector initiative designed to transform the Local Authorities in Zambia into self-sustaining business entities. This initiative will enable the Local Authorities to achieve their mandate of sustainable service delivery. The programme provides a variety of interventions, from off-balance sheet financing, systems transformation, capacity building to private sector partnerships. It is designed to enable the Local Authorities become part of the solutions to attain the SDGs and the goals of the National Development Plan.

The increasing effects of climate change across the globe calls for concerted efforts and partnerships in the provision of efficient and sustainable climate change services that respond to both mitigation and adaptation. Our climate change programme, builds on the projects we engage with, through financial and technical advisory services, to measure and capture the impact for effective climate finance blending. Working with local and global partners, we are creating project portfolios which will increase climate finance inflows and leverage private capital into portfolios across sectors.

Working with our local and international partners, Lloyds provides financial and technical advisory services in structuring and project managing infrastructure projects. Our infrastructure programme is closely linked to the support services we provide to the National and Local Governments. To structure the projects effectively, we use various datasets, least cost models and financial engineering solutions. This programme issues financial instruments in the market either on project portfolios or on a project- by-project basis.

At Lloyds, we incorporate one common feature in all our resource mobilisation or project implementation programmes – risk mitigation strategy and mechanism. Each assignment or project is designed with its own solution specific to its risk mitigation strategy and mechanism. On each assignment, we try to anticipate likely risk scenarios that could occur and affect the anticipated success of the assignment or implementation of the project. While we can never predict the future with certainty, our structured and forensic risk mitigation approach to risk management in project implementation processes, is able to adequately predict the uncertainties in the projects, and in the process, minimize the occurrence or impact of these uncertainties.

In memory of Sabera Khan, who initiated this program at Lloyds Financials, The Southern African Impact Investment Fund (SAIIF) is a Fund designed to support commercially viable investments with high social and environmental impacts, which result in regional scalability of business models. SAIIF will co-finance projects in the areas of agriculture value chain, infrastructure development and renewable energy. Our focus on energy is for productive use and climate change to significantly and ethically achieve national Sustainable Development Goals.